Company Overview

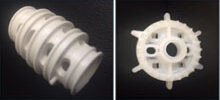

Manufacturer of highly engineered and high precision injection molded components that service diverse end markets.

Transaction Overview

MPE acquired PCI through a limited process conducted by an intermediary. MPE was selected by the founder and management team as their preferred partner due to MPE’s experience with family-owned businesses, ability to facilitate a succession plan for the retiring owner, and a highly relevant Executive Council relationship.

Transaction Outcome

MPE successfully onboarded a new CEO and CFO to professionalize the organization, acquired and integrated two strategic add-ons, and generated a strong new business development pipeline, before selling to Rosti Group AB, a Swedish-based strategic, in 2021.

Original Investment Thesis

- Highly automated manufacturing model, which utilizes scientific injection molding processes and removes direct labor input

- Market trend of metal-to-plastic conversions for functional parts, as customers value favorable part cost and weight characteristics

- Talented incumbent management team and identified augmentation opportunity

Company-Building Approach

- Successfully facilitated transition to retirement for PCI’s selling shareholder

- Recruited new CEO and CFO within six months of closing to professionalize the business and provide the foundation for growth

- Identified MPE finance resource to serve as interim CFO post-closing to ensure a smooth transition to institutional ownership

- Created stock option program for management

- Expanded wallet share with existing customer base by identifying growth potential with core customers

- Added sales and marketing resources to increase new business development activities beyond the Upper Midwest

- Successfully integrated two accretive acquisitions, thereby expanding geographic presence and entering new end markets

- Added manufacturing and service capabilities

- Improved asset utilization by making investments in additional equipment and automation

- Developed continuous improvement culture by evaluating opportunities to enhance manufacturing capabilities and implementing operational metrics

- Expanded systems and talent by implementing an annual incentive bonus plan as well as employee training and development programs

- Used a modest amount of leverage and preserved flexibility to invest in the business for the long run

- Developed pipeline of complementary and accretive add-on acquisitions

- Developed formal reporting of monthly financial results and instituted annual budgeting process

- Conducted frequently analyses on margins by customer and refined operational KPIs